After working so hard to earn money and live a comfortable life, it could become frustrating to find yourself broke too often even before the next payday. You then ask yourself, “Where did all the money go?” You see; financial planning is not about how much money you make but how well you use it. Planning our finances or managing our money is something we ought to be able to do effectively if we ever want to take control of our lives and live worry-free. The Chartered Institute For Securities & Investments, U.K, defines financial planning as an “ongoing process to help you make sensible decisions about money that can help you achieve goals in life.” Since we all have goals and aspirations, irrespective of our class or strata in life, we also need to be able to make sensible decisions about our finances. This will help us plan for emergencies and invest for a brighter financial future.

Tips For Financial Planning

Here are simple money rules to follow for effective financial planning:

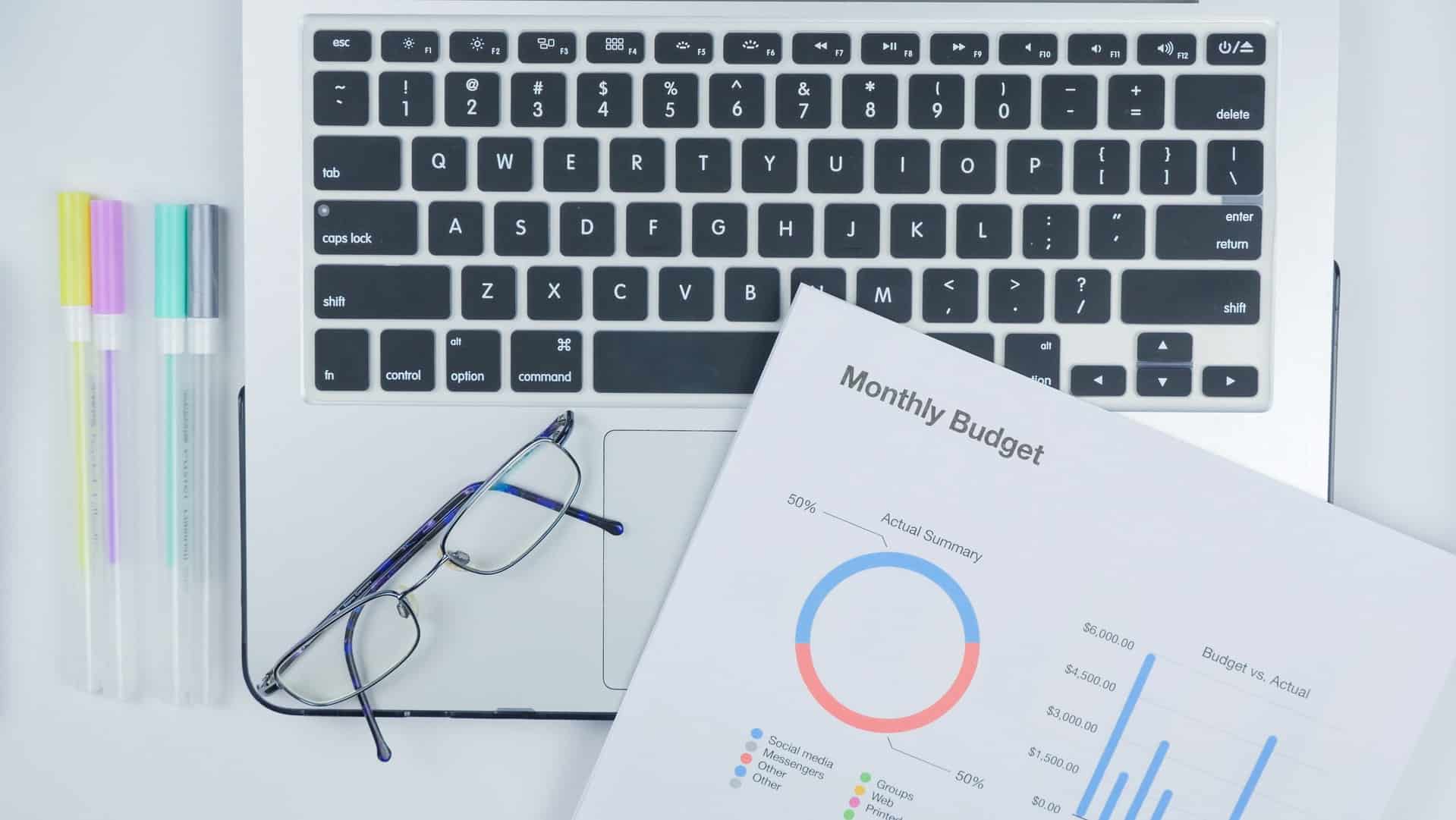

1. Budgeting is the new cool

Make a list of all your expenditures for the month. Impossible? Definitely not! Get a pen and paper and write out everything you spend money on. You can make it a daily or weekly list, but round it up for the whole month. After adding it up, deduct the total from your monthly income. If your expenses are more than your income, then you have some serious cutting down to do. Now, for everything you need, write out the amount of money for each item and stick with it. Money gets lost when it doesn’t know where to go. Spend money on things that are really important to you. Financial planning requires circumspection. Think deeply before you spend money on that item. If you have dependents you cater for, place them on a monthly stipend and get them to understand you cannot go outside the plan. If you have to spend money as the need comes, like many do, be rest assured there will be none left for personal savings.

2. Save towards fees separately

Starting a savings plan for school fees may initially seem like a daunting task. However, when the money sums up, and you are ready to remit the fees, the relief is simply extraordinary. School fees are often not paid monthly. So you have 3 – 4 months to save. Do it judiciously! It makes the financial burden lighter on you. Plans like the Leadway Education Savings Plan and Education Target Plan have been carefully structured to help you conform to this rule without much stress.

3. Never spend above your earning

Oftentimes, this is the problem. Your monthly expenditure is way more than what you earn. Try to live below what your income is by cutting down on things that are not so necessary to your daily survival. Contrary to what many people do, never make purchases in anticipation of an expected income. This will save you from getting into unnecessary debts when there are disappointments. Experts advise that you save before you spend. With this mindset, there is hope for a brighter tomorrow.

4. Always do the “Need” or “Want” check

There will always be needs as well as wants. Prioritizing will help you make a clear decision on where to spend your money. Before you stock up on that extra pair of shoes or splurge on that new game set, ask yourself, “Is this what I want or what I need?” Your needs are the first things you should take care of and when that is met, you can then decide to spend money on what you want. When you manage your finances well, affording your wants will be easier. Don’t confuse the two.

5. Save for every project no matter how small

You cannot grow your money without saving. In addition, it’s crucial to plan against losses that may arise from unforeseen circumstances and plan for emergencies by taking up appropriate insurance policies. If you have something you need money to achieve, start early to save towards it. Plan to save every month. Your savings should be treated as if it was a monthly bill payment. Even if you default in some months, make it up. Stick to the savings plan and never give up on saving. Like the popular saying, little drops of water make a mighty ocean.

6. Say No to debts. Carry expenses over to the following month

Reality check! If you need money for some expenses and you don’t have enough at the moment, then you cannot afford it. It is safer to shift that expense to the following month or when you can conveniently pull it off. Debts can be like an endless nightmare. But they are avoidable. If you are already in debt, start paying your debt off bit by bit. Work out the amount you can afford to pay back monthly and stick with it.

7. Recycle your money

One of the goals of recycling is to avoid wastage. Using up all your money without using a part of it to generate more wealth is a form of waste. Get involved in savings and investments plans that secure a beautiful future for you. Investing your money means you are sending your money to work for you. In T. Harv Eker’s words, “Rich people have their money work hard for them and poor people work hard for their money… the single biggest difference between financial success and financial failure is how well you manage your money. It’s simple: to master money, you must manage money.”

The Bottom Line

Splurging on beautiful things and shiny gadgets is cool, but what does your bill read at the end of the month? No matter how much money you earn, if you don’t manage your finances, you will always have issues with money. One of the best decisions you can make in effectively managing your money and assets is by taking up appropriate insurance policies that provide a guarantee against losses when the unexpected occurs. For business people, policies like the LBOSS come highly recommended. Financial planning is not a game. Practice the acts of money management and you will find yourself living a money stress-free life.