Insurance is a financial safety net that protects against something going wrong — such as a car accident, fire, theft, or death. When you purchase insurance, you receive an insurance policy, which is a legal contract between you and your insurer (the insurance company). Below, we’ve collected 12 key statistics exploring the rate of insurance penetration in Nigeria, the gross value of life insurance premiums, and industry ranking in the world among others.

There’s something here for everyone to learn. Compare what you already know with these insurance statistics and share it with others.

What is the history of insurance in Nigeria?

Soon after independence, the government set out to survey the insurance sector. The ensuing report which was carried out by the JC Obande commission in 1961, laid the groundwork for the establishment of the Department of Insurance in the Federal Ministry of Trade.

The report also led to the introduction of Nigeria’s first insurance-related piece of legislation, the insurance companies Act No. 58 of 1961, which came into effect in May 1967.

Over the following decades the Department of Insurance which was eventually relocated under the Federal Ministry of Finance (FMF), issued a number of updates and revisions to the 1961 Act.

Insurance decree No. 59 of 1976 for instance was widely regarded as the nation’s first comprehensive set of insurance regulations.

Decree 40 of 1988 meanwhile, made provisions for the burgeoning life insurance segment, while Decree 20 of 1989 mandated that all insurance companies operating in Nigeria were required to contribute 1% of their earnings to the newly formed insurance special supervisory fund, which was drawn by the regulator to cover operating costs.

In 1992, the insurance regulators were formally spun off into a semi-independent entity, known as the national insurance supervisory board which was given far-reaching regulatory powers, finally under decree No 1 of 1997 the organisation was changed to the National Insurance Commission (NAICOM), and a range of norms was put in place across the industry, in line with international standards.

The ruling continues to serve as the basis of NAICOM’s authority today, though the regulators have introduced a wide range of new decrees and other regulations in the intervening two decades.

Infographic: Insurance Statistics in Nigeria

1. How big is the insurance industry in Nigeria?

The Nigerian industry ranks 62nd in the world with $1.64 billion premium representing 0.2% of premiums collected globally in 2018. [Nigeran Stock Exchange (NSE), 2019].

Based on Augusto and Co, 2022 insurance industry report, the industry Gross Premium Income (GPI) stands at ₦520.1 trillion.

2. Rate of insurance penetration in Nigeria

The rate of insurance penetration in Nigeria has been regarded as one of the lowest and worst in Africa with a 0.5% penetration rate as of March, 2022.

3. What percentage of Nigerians are insured?

0.5% of Nigerians have insurance. According to several reports, Nigeria, the largest African economy with a GDP of 443 billion USD as of 2020 and the most populous African country with a population of over 195 million only has an insurance penetration rate of less than 1 per cent.

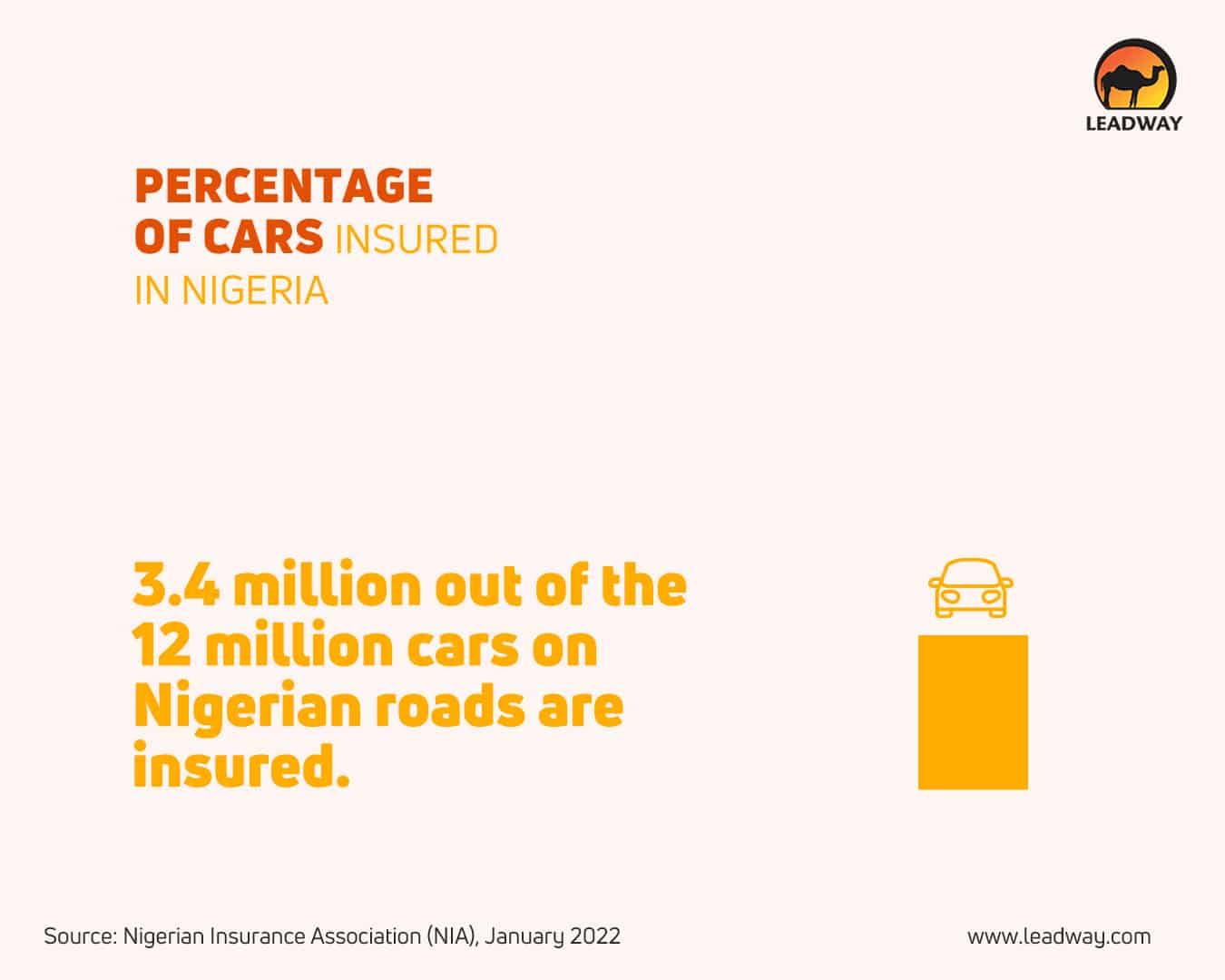

4. Percentage of cars insured in Nigeria

According to a report from the Nigerian Insurance Association (NIA), as of January 2022, only about 3.4 million out of the 12 million cars on Nigerian roads are insured.

5. Percentage of Nigerians with health insurance

Based on this report by Statista, as of 2018, about 97% of people surveyed in Nigeria did not have any health insurance.

According to a report from Dataphtye, about 3% of Nigerians have health insurance which is provided mostly by employers. Of this 3%, men have more insurance coverage than women as 56.7% of those covered are male against 43.3% of the women.

Employer-based insurance: Male (3%) and Female (1.9%),

Mutual health organisation/community based insurance: Male (0.2%) and Female (0.5%),

Privately purchased commercial insurance: Male (0.1%) and Female (0%),

Others: Male (0.2%) and Female (0.1%).

6. Value of gross written life insurance premiums in Nigeria

In 2020, the value of gross life insurance premiums written in Nigeria amounted to 484.9million euros. [Source]

7. Value of gross written [other] insurance premiums in Nigeria

According to a report from Statista, the value of other insurance premiums written in Nigeria amounted to 665.4million euros as of 2020.

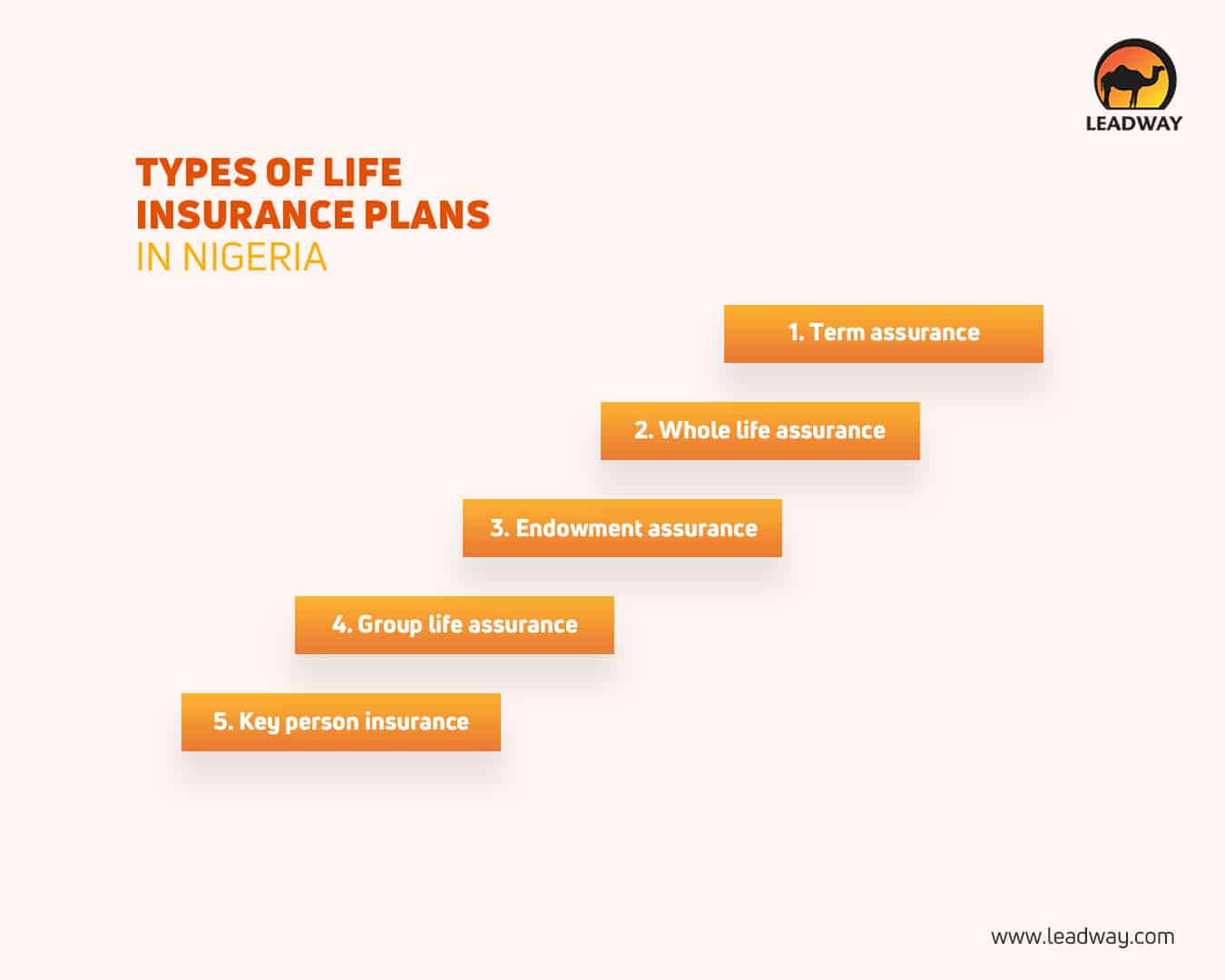

8. Types of life insurance plans in Nigeria

- Term assurance

- Whole life assurance

- Endowment assurance

- Group life assurance

- Key person insurance

9. How many life insurance companies are in Nigeria?

According to NAICOM, there are presently about 58 Life insurance companies in Nigeria.

10. Nigerian Insurance Industry ranking in the world

The Nigerian industry ranks 62nd in the world with $1.64Billion. According to the Nigerian Stock Exchange (NSE) in its 2019 report, the Nigeria insurance industry ranks 62nd in the world with $1.64billion premium representing 0.2 per cent of premiums collected globally.

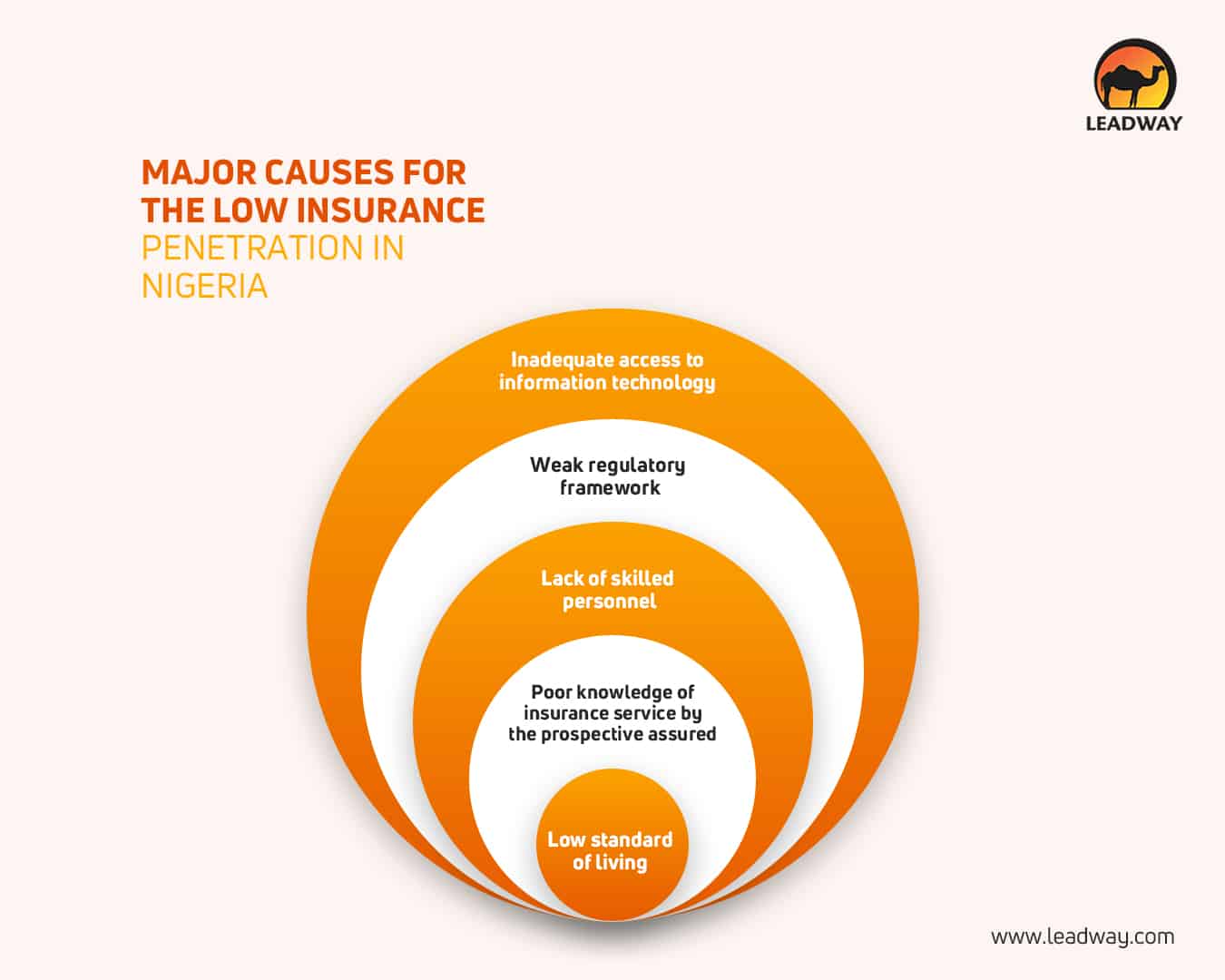

11. Major causes for the low insurance penetration in Nigeria

The Nigerian market is doubtful of insurance companies as a result of these reasons:

- Inadequate access to information technology

- Weak regulatory framework

- Lack of skilled personnel

- Poor knowledge of insurance service by the prospective assured

- Low standard of living

12. What are the challenges facing the insurance industry in Nigeria?

The Nigerian Insurance industry faces a series of challenges but the top four (4) are:

- Inappropriate pricing and risk profiling

- Poor product-market fit

- Inadequate distribution channels

- Low public confidence.

Is there anything else you’d like to know about insurance statistics in Nigeria and wish was included in this article? Let us know in the comments below!

Also, don’t forget to share this post!